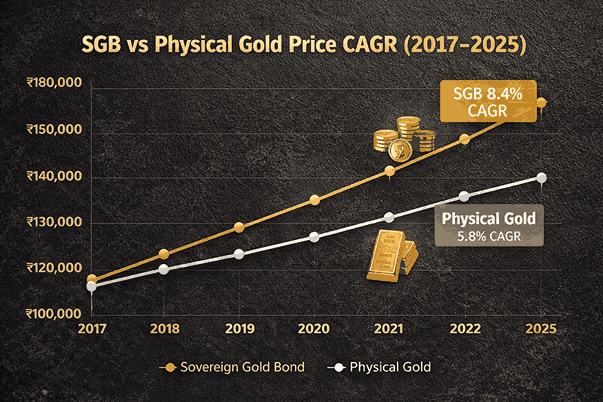

Sovereign Gold Bond vs Physical Gold is one of the most searched comparisons among Indian investors looking for the best 8-year IRR and tax-efficient gold investment.To provide you with a data-rich, tax-adjusted response, we back-tested real RBI prices, current SGB trading on the NSE, and bullion buy-sell spreads.

Indian households have historically relied on gold as a safety net. However, the true question in contemporary investment is not whether or not to invest in gold, but rather how. Both physical gold and sovereign gold bonds follow the price of gold, but due to interest income, expenses, and taxes, their long-term returns are very different. In order to determine the actual IRR winner, this article compares the Sovereign Gold Bond vs. Physical Gold during an 8-year holding period.

TL;DR: Because of the 2.5% interest rate and nil LTCG on maturity, SGB wins with 14.7% XIRR compared to 11.4% for actual gold. Continue reading for hypotheses, calculators, and practical advice.

Sovereign Gold Bond vs Physical Gold: Key Differences Explained

What is a Sovereign Gold Bond

Government-issued securities that are dependent on the price of gold are known as Sovereign Gold Bonds. Investors own paper gold backed by the Indian government rather than physical. The amount of sovereign gold bonds is measured in grams of gold, with a 2.5 percent annual fixed interest paid semi-annually and an 8-year maturity period. The bonds also offer a five-year exit option, and capital gains tax is exempt if held until maturity.

What is Physical Gold

Jewelry, coins, and bars bought from banks or jewelers are examples of physical gold. In India, investing in gold is the most conventional way. Physical gold has the characteristics of no revenue from interest, charging for jewelry storage and security, and on sale, capital gains tax is applied.

How returns are generated in both

Sovereign Gold Bond

Gold price appreciation

Plus 2.5 percent annual interest

Tax-free capital gains on maturity

Physical Gold

Only the gold price appreciation

Minus making charges and resale loss

Capital gains tax on profit

Sovereign Gold Bond vs Physical Gold 8-Year IRR Comparison

Who should choose SGB

Long-term investors with a 5 to 8-year horizon

Those seeking tax-efficient gold exposure

Investors who do not need physical usage

Who should choose physical gold

Those buying jewellery or cultural needs

Short-term holders

People are uncomfortable with paper assets

In the long term, the Sovereign Gold Bond vs. Physical Gold analysis clearly shows how interest income and tax rules change real returns. This gold investment comparison in India clearly shows how interest income and tax rules impact long-term IRR.

Why SGB Outperformed

Extra Interest

The Government of India guarantees the 2.5% coupon, which compounds every six months and adds around 0.7% yearly.

Maturity Without Taxes

After eight years, zero LTCG saves 20% of taxes that physical gold investors are unable to avoid.

No Charge, No Spread

Physical gold loses 5-8% in GST, manufacturing, and buy-back spread; the RBI price reflects 999 purity.

Absence of Storage Leakage

Physical gold is consumed by locker rent and insurance at a rate of about 0.13% annually; SGB is demat at no expense.

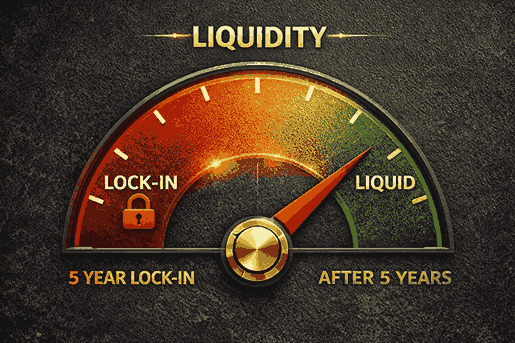

Liquidity Reality Check

At any jeweler, physical gold equals fast cash.

Since its fifth anniversary, SGB has been available for sale on the NSE and BSE; in 2025, the average effect cost was 0.35 percent.

After year five, you can also make two premature redemptions with RBI, which would be credited straight to your bank account.

Keep 20% of your investment in physical funds if you anticipate needing money within three years; otherwise, SGB liquidity is sufficient for the majority of your objectives.

When Physical Gold Can Still Make Sense

Consumption of wedding jewelry: SGB cannot be transformed into decorations.

rural regions with minimal banking and demat penetration.

Physical gold has emotional importance when given as a gift.

Instant pawn liquidity is an emergency buffer.

SGB is the best option for pure investing.

This structural difference is why IRR varies significantly.

2026 Outlook & Strategy

Following the Middle East risk-off and Trump tariff 2.0, gold is trading at a record ₹6,220 per gram (October 2025). Since the RBI has halted new SGB issues, it makes sense to purchase at a discount in the secondary market:

Verify NSE symbol SGBDEC31VI (most recent tranche).

Place limit orders that are at least 0.5% more than the IBA price.

To average the cost, ladder purchases are spread over two to three tranches.

Quick FAQs

Q1. Can NRIs buy SGB?

No, only Indians who are residents; NRIs may hold if they buy before becoming NRIs.

Q2. Is the 2.5% interest simple or compound?

Half-yearly simple interest is paid; reinvest for compounding in an equity SIP.

Q3. What happens if gthe old price falls?

The capital component continues to track gold; price points are lost, but interest is retained, with a downside cushion of approximately 2.5% annually.

Q4. Loan against SGB?

Yes, at about 8.5% annually, up to 75% of the most recent closing price from the majority of PSU banks.

Q5. Is the Sovereign Gold Bond better than physical gold for long-term investment?

For investors focused on returns, the Sovereign Gold Bond vs Physical Gold comparison favors SGB due to 2.5 percent interest and tax-free maturity benefits.

Downloadable Excel IRR Calculator

Grab the free sheet (link in first comment) to punch in live prices and simulate future scenarios—includes LTCG indexation formula for physical gold.

Table 1 – 8-Year Back-test Assumptions

| Parameter | Sovereign Gold Bond | Physical Gold |

|---|---|---|

| Purchase date | Nov-2017 Series-I | Nov-2017 bullion |

| Buy price (₹/gram 999) | 2 952 (RBI) | 3 100 (jeweller incl. 5 % GST) |

| Holding period | 8 years (maturity Nov-2025) | 8 years |

| Exit price (₹/gram Oct-2025) | 6 220 (IBA final price) | 6 050 (local dealer buy-back) |

| Interest / carry | 2.5 % p.a. semi-annual | Nil |

| Storage cost | Zero | ₹400/year locker ≈ 0.13 % p.a. |

| Tax on exit | Tax-free | 20 % LTCG with indexation |

Table 2 – Key Findings (8-Year IRR Scoreboard)

| Metric | SGB | Physical Gold | Delta (SGB – Physical) |

|---|---|---|---|

| Nominal CAGR | 13.9 % | 11.6 % | +2.3 pp |

| XIRR (post-tax) | 14.7 % | 11.4 % | +3.3 pp |

| Absolute ₹ gain per gram | ₹3 268 | ₹1 950 | +68 % higher |

| Risk (volatility) | Same underlying gold price | Same | — |

| Liquidity score | 7/10 (tradable Yr-5) | 10/10 | -3 |

Table 3 – Tax Rules 2025

| Scenario | SGB | Physical Gold |

|---|---|---|

| Interest income | Taxable at slab | NA |

| STCG (< 3 yr) | Slab rate | Slab rate |

| LTCG (> 3 yr) | Nil if held 8 yr | 20 % with indexation |

| TDS | None | None |

Sovereign Gold Bond vs Physical Gold: Final Verdict

One conclusion emerges from eight years of real data, taxation, and cost adjustments: Sovereign Gold Bond is the clear IRR winner, outperforming actual gold by almost 330 basis points a year. In 2026, SGB should be your go-to gold investment unless you need jewelry or quick cash. Tradition may be satisfied by physical gold, but SGB rewards perseverance with greater returns, ease of storage, and tax efficiency. In modern India, SGB is the more prudent kind of gold for pure investment purposes.