Managing money becomes easier when you can clearly calculate costs, savings, and future needs. Instead of guessing, financial decisions should be backed by numbers. Most financial mistakes happen not because people earn less, but because decisions are made without clear numbers. Guessing EMIs, investments, taxes, or savings goals often leads to stress later.

FinanceRead calculators are built to solve this exact problem.

This page brings together all free personal finance calculators on FinanceRead.in. These tools help you calculate loans, taxes, investments, savings, and overall financial health in one place. Whether you are planning a budget, reducing taxes, or checking loan affordability, these calculators provide quick and practical answers.

All calculators are designed for Indian users, based on current financial rules and common personal finance situations. On this page, you’ll find simple, accurate, India-specific personal finance calculators that help you plan loans, investments, taxes, savings, and long-term goals without complicated formulas or confusing jargon.

Whether you are salaried, self-employed, planning retirement, or just starting your money journey, these tools give clarity before you commit.

All-in-One & Core Calculators

These calculators form the foundation of smart financial planning. Start here if you want a complete overview.

All-in-One Finance Calculator

This combined calculator lets you calculate EMI, SIP returns, FD maturity, and RD growth on a single page. It is ideal for users who want quick comparisons without jumping between tools.

Cost of Debt Calculator

This calculator shows the real cost of borrowing by considering interest rate, tenure, and repayment structure.

Loan Calculator

This calculator helps estimate EMI, total interest paid, and total loan cost before borrowing. It is useful for comparing loan offers and planning affordability.

SECTION 1: LOAN & CREDIT CALCULATORS

1. Home Loan EMI Calculator

Home loan emi calculator is specifically designed for long-term housing loans, this calculator shows EMI, interest outgo, and tenure impact. Calculate your monthly home loan EMI, total interest cost, and total repayment amount before applying for a housing loan.

2. Loan and Credit Calculator

This calculator prevents surprises. Understand borrowing costs, interest rates, and repayment amounts for different types of loans and credit. Loans initially feel manageable, but become burdensome later if EMI planning is poor.

3. Credit Card Interest Calculator

this credit card interest calculator makes one understand the real cost of revolving credit. This tool helps you understand how unpaid credit card balances grow rapidly due to high interest rates.

SECTION 2: TAX & SALARY CALCULATORS

4. Income Tax Calculator (New vs Old Regime)

This income tax calculator compares tax liability under the old and new tax regimes and see which option is better for your income. This calculator helps you estimate tax payable under the new or old tax regime based on your income and deductions.

5. Section 80C Tax Saving Calculator

This sec 80c tax saving calculator calculates eligible tax deductions under Section 80C. This tool shows how much tax you can save using investments like ELSS, PPF, EPF, and insurance under Section 80C.

6. HRA Calculator

HRA calculator calculates House Rent Allowance exemption and taxable HRA based on salary, rent paid, and city type. If you live in a rented house, this calculator helps determine how much House Rent Allowance exemption you can claim.

SECTION 3: INVESTMENT & SAVINGS CALCULATORS

7. SIP Calculator

A SIP calculator helps you estimate how much your monthly investments can grow over time based on expected returns and duration. It is ideal for beginners and long-term investors who want to build wealth gradually.

8. Lump Sum Investment Calculator

This calculator calculates returns on one-time investments based on the expected rate of return and investment duration. If you plan to invest a one-time amount, this calculator shows how much it can grow over the years with compounding. Useful when investing bonuses, savings, or inheritance.

9. SIP to ₹1 Crore Calculator

This calculator helps you understand how much monthly SIP is required to reach ₹1 crore based on time and expected returns. It is a powerful goal-planning tool for long-term investors.

SECTION 4: FINANCIAL PLANNING CALCULATORS

10. Monthly Budget Calculator

Track monthly income, expenses, and savings to improve budgeting and spending control. It helps you track income, expenses, and savings so you know where your money actually goes.

11. Emergency Fund Calculator

Calculate how much emergency savings you need to stay financially secure during unexpected situations. This calculator shows how much emergency fund you need based on your monthly expenses and job stability.

12. Net Worth Calculator

Calculate your assets minus liabilities to understand your true financial position. Shows your true financial position by subtracting liabilities from assets.

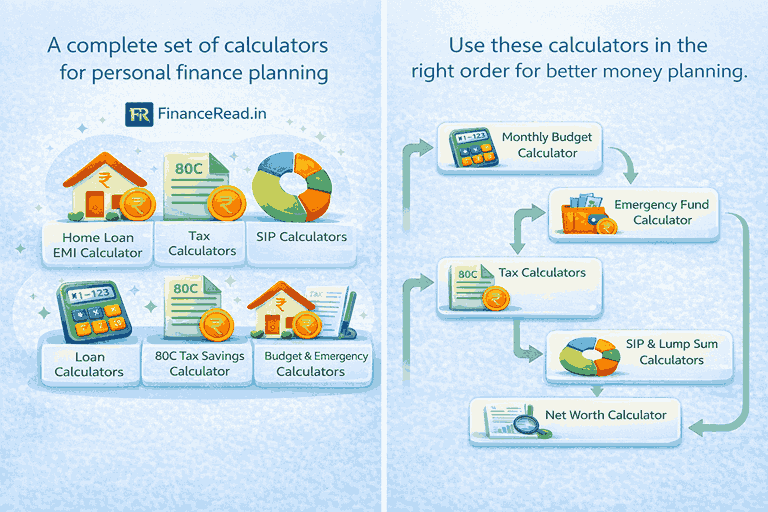

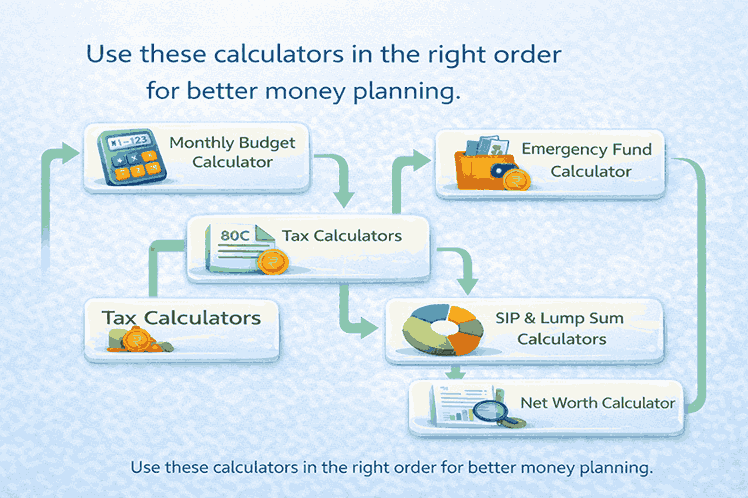

HOW TO USE THESE CALCULATORS TOGETHER (VERY POWERFUL SECTION)

You don’t need to use all the calculators at once. A simple flow works best:

- Start with the Monthly Budget Calculator to understand income and expenses

- Build safety using the Emergency Fund Calculator

- Check loan affordability using the Home Loan EMI Calculator

- Reduce tax using the HRA Calculator and Section 80C Calculator

- Plan investments with SIP and Lump Sum Calculators

- Track progress using the Net Worth Calculator

This step-by-step approach helps in building strong and sustainable personal finances.

Why FinanceRead Calculators Are Reliable

Built for Indian rules and assumptions

Simple inputs and clear outputs

No login or personal data required

Free to use with no hidden conditions

Our focus is clarity, not complexity.

CONCLUSION (SHORT & STRONG)

Personal finance decisions should be data-driven, not based on guesswork. These calculators on FinanceRead.in are designed to simplify complex financial calculations and help you make informed decisions with confidence. For financial awareness and official guidance, visit the Reserve Bank of India (RBI) website.

Bookmark this page and revisit it whenever you need to calculate loans, taxes, investments, or savings. This calculator hub will continue to grow with more tools to support your financial journey.

FAQs

Q1. Are these calculators accurate?

They provide realistic estimates based on standard financial formulas.

Q2. Can beginners use these tools?

Yes, no prior finance knowledge is required.

Q3. Are these personal finance calculators free to use?

Yes, all personal finance calculators on FinanceRead.in are completely free to use. You can calculate EMI, tax savings, SIP returns, budgeting, and more without registration.

Q4: Which calculator should I use first for better financial planning?

Start with the Monthly Budget Calculator to track income and expenses, then build safety using the Emergency Fund Calculator. After that, use loan, tax, and investment calculators based on your goals.