If you are searching for the best large-cap funds for retirement in India, this guide will help you shortlist the right options for long-term wealth building. Retirement planning is crucial, as your salary typically comes to an end at this stage, and you should exercise caution when planning for retirement. It is not about becoming rich overnight; it is about building a safe and growing money pool that can support your monthly needs when your salary stops.

And in India, one of the smartest long-term ways to build a retirement corpus is through large-cap mutual funds. Because large-cap funds invest in the country’s biggest and strongest companies, like top banks, IT leaders, FMCG giants, and industrial champions. These are the businesses that usually survive market crashes better and recover faster compared to smaller companies.

Now, as we enter 2026, many investors are again asking the same question: “Which large-cap funds are best for retirement in 2026?” The truth is, you don’t need 10 funds or complicated strategies. You only need 2 to 3 good long-term large-cap funds, a disciplined SIP plan, and a clear retirement goal.

This article lists the best large-cap funds for retirement in India, suitable for long-term investors. It provides a simple selection logic, explains how to invest through SIP or lump sum, and outlines the safest way to utilize these funds for long-term retirement wealth. In this guide, we explain the best large-cap funds for retirement in India for 2026, how to invest through SIP, and how to build a stable retirement corpus with low stress and long-term compounding.

Best Large-Cap Funds for Retirement in India (Top Picks)

How I picked the 2025 top large-cap funds (selection checklist)

Shortlist criteria used for these picks

- At least three years of consistent returns relative to category peers.

- Reasonable expense ratio for direct plans.

- Large and stable AUM (shows investor trust and liquidity).

- Low to moderate portfolio overlap with other large-cap picks (portfolio diversification).

- Manager stability and a clear investment process.

Data for the shortlist was checked from leading Indian mutual fund trackers and fund comparison sites to ensure up-to-date performance and ratings.

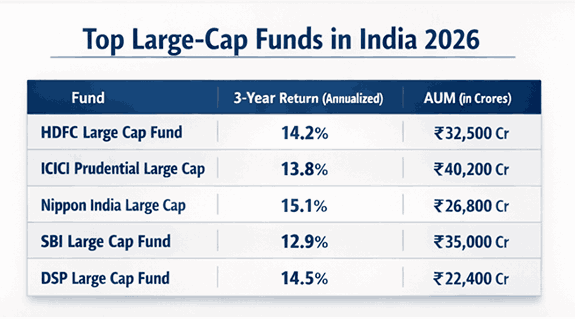

2026 top picks — quick snapshot

- HDFC Large Cap Fund — long-term consistency and strong research-backed stock selection.

- Nippon India Large Cap Fund — aggressive returns in recent years while staying within large-cap discipline.

- ICICI Prudential Large Cap Fund — large AUM and steady multi-year performance.

- SBI Large Cap Fund — a value-oriented large-cap choice with a wide distribution.

- DSP/DSP Large Cap Fund — strong recent returns and consistent stock-picking; appears among top performers on trackers.

These are the best large-cap funds for retirement in India because they invest in strong, stable companies and are suitable for long-term SIP investing.

Comparison Table showing the Best Large-cap funds for Retirement in India

| Fund Name (Direct Plan) | Category | Best For | Risk Level | Why It’s Good for Retirement |

|---|---|---|---|---|

| HDFC Large Cap Fund | Large Cap | Conservative long-term investors | Moderate | Strong long-term consistency and quality portfolio |

| ICICI Prudential Large Cap Fund | Large Cap | Balanced retirement SIP portfolio | Moderate | Stable performance with large AUM and disciplined approach |

| Nippon India Large Cap Fund | Large Cap | Growth-focused retirement investors | Moderate-High | Better upside potential with a strong large-cap selection |

| SBI Large Cap Fund | Large Cap | Value-style investors | Moderate | Often value-tilted, suitable for long-horizon retirement |

| DSP Large Cap Fund | Large Cap | Better upside potential with a strong, large-cap selection | Moderate | Strong manager process and competitive long-term results |

SIP Section

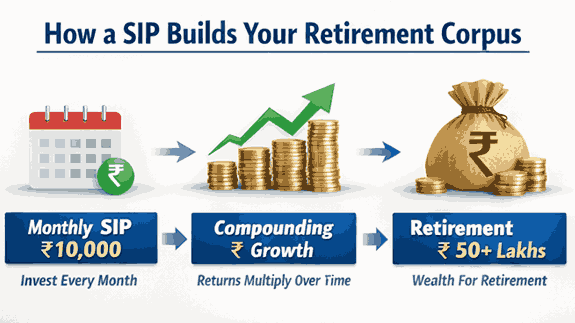

A monthly SIP in the best large-cap funds for retirement in India can be a simple and low-stress way to build a retirement corpus over 10–20 years.

Why consider these funds

HDFC Large Cap Fund is historically among the more consistent large-cap active funds; it invests in market leaders across sectors and typically shows stable multi-year returns.

Nippon India Large Cap Fund has delivered higher-than-category returns at times and remains a popular large-cap pick among platform curations.

ICICI Prudential Large Cap Fund has a large AUM and a track record of steady returns, good for investors who want an institutional-sized, well-distributed fund.

SBI Large Cap Fund has a value tilt and a wide distribution make it a sensible core holding for many retail investors; it can act as a conservative large-cap anchor.

DSP Large Cap Fund appears among top performers in category snapshots and often scores high on platform return tables; suitable for investors who want an actively managed pick with recent outperformance.

How to use these funds for retirement

simple allocation playbooks

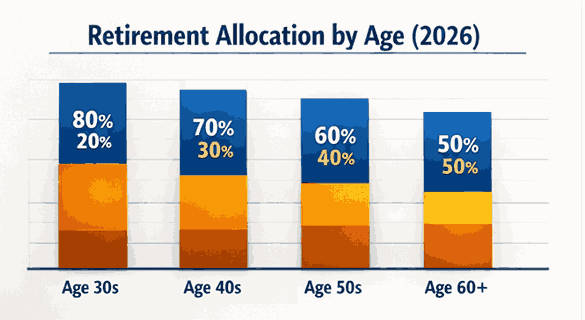

Conservative starter (age 55+ or low risk tolerance)

• 60% large-cap equity (use 1–2 of the above funds)

• 40% debt (bank FDs, short-duration funds or gilt funds)

Balanced growth (age 45 to 55)

• 70% equity (40% large-cap core + 30% diversified multi-cap/large & mid)

• 30% debt

Aggressive compounding (age 30 to 45)

• 80–90% equity (50% large-cap core via 1–3 funds + rest in mid/small/multi-cap for growth)

• Use SIPs for rupee-cost averaging and a lump sum if you have surplus cash

SIP vs. lump sum guidance

• SIPs: best for disciplined retirement saving and mitigating timing risk.

• Lump sum: consider only if you believe the valuation is attractive and you can tolerate short-term volatility. For a retirement horizon longer than 8–10 years, a lump sum into a diversified large-cap core can work well.

Risks, tax, and exit points to remember

- Market risk: Large caps reduce but don’t eliminate market volatility.

- Concentration risk: Some funds may be heavily invested in a few sectors; check the top 10 holdings.

- Tax: equity funds held over 1 year qualify for long-term capital gains (LTCG) treatment in India; gains above the LTCG exemption threshold are taxed as per current rules — verify the latest tax slabs before planning withdrawals.

- Exit: for retirement, avoid panic selling during a 6–12 month correction. Instead, use staggered exit (e.g., convert to debt or use SWP) and lock in gradual income. (Check current tax rules/limits before acting).

Practical checklist before you invest

- Choose the direct plan, not the regular.

- Compare expense ratios and AUM across platforms.

- Check the fund’s 3- and 5-year rolling returns and drawdown history.

- Review the top 10 holdings and sector concentration.

- Prefer SIPs for steady retirement accumulation, build an emergency fund first.

- Rebalance annually to maintain target allocation.

2026: What to Expect in Markets (100–150 words)

As we move into 2026, Indian equity markets may continue to remain positive in the long term, but short-term volatility is still expected. Factors like inflation control, RBI interest rate decisions, global crude oil prices, foreign investor flows, and geopolitical events can cause ups and downs even in large-cap stocks.

The good news is that large-cap companies usually remain more stable compared to mid and small caps because they have strong cash flow, proven business models, and better ability to handle economic slowdowns.

For retirement investors, 2026 should not be treated as a “quick profit year.” Instead, it should be treated as a year to build discipline through SIPs, stay invested, and focus on quality funds that can deliver steady compounding over the next 10–20 years.

3 Callout Boxes (Ready Content)

Callout Box 1 (Quick Summary Box)

Title: Quick Summary (For Busy Readers)

If you want a stable retirement portfolio in 2026, start with 1–2 large-cap mutual funds and invest through a monthly SIP. Large-cap funds focus on India’s strongest companies, so they usually show lower ups and downs than mid and small-cap funds. Retirement wealth is built through time + discipline, not by switching funds every year.

Callout Box 2 (Pro Tip Box)

Title: Pro Tip (Best Retirement Strategy)

Instead of trying to “find the perfect fund, choose one good large-cap fund and run a SIP for 12 months without interruption. Then review once a year. If needed, add a second fund to reduce fund-manager risk. This simple 2-fund strategy works better for retirement than holding 6–8 overlapping mutual funds.

Callout Box 3 (Warning Box)

Title: Warning (Common Mistake Investors Make)

Do not invest your entire retirement savings only in equity funds. Even large-cap funds can fall during market crashes. For retirement planning, always keep proper balance: equity for growth + debt for safety. Without debt allocation, you may panic-sell at the wrong time and damage your retirement plan.

Risk/tax section

Even the best large-cap funds for retirement in India can fall during market corrections, so avoid panic selling and stay invested for the long term.

CONCLUSION

Choosing the best large-cap funds for retirement in 2026 is not about chasing the highest return fund from last year, 2025. It is about choosing funds that can give you stable growth for the next 10 to 20 years with less stress and fewer shocks. Large-cap funds are ideal for retirement because they invest in strong, well-established companies.

They may not always give fast returns like small-caps, but over time, they can help you create a solid retirement corpus with peace of mind. Start your SIP today with the best large-cap funds for retirement in India and stay invested for the long term.

If you are serious about retirement planning in 2026, large-cap mutual funds can be your safest equity foundation. The key is not choosing “the fastest fund,” but choosing a fund you can hold calmly for 10–20 years through every market cycle. To stay financially independent after retirement, start early and invest consistently in the best large-cap funds for retirement in India.

Now I want to ask you one simple question:

Are you investing for retirement with a clear monthly SIP target, or just saving whenever possible?

If you want, I can help you build a simple retirement plan based on your age and goal, including:

a monthly SIP amount, the right equity-debt ratio, and a 2-fund retirement portfolio that is easy to manage.

Comment “RETIREMENT” below and tell me your age + retirement target amount, and I will suggest the best SIP roadmap.

Start early with the monthly investment through SIP(systematic investment plan) by staying consistent and reviewing once a year.

Even if the market moves up and down in the short term, do not be discouraged, as disciplined investing in quality large-cap funds can keep you on track for your retirement goal.

Before investing, always check the latest expense ratio, portfolio holdings, and fund factsheet. And remember — your retirement plan becomes powerful not because of one fund, but because of consistent investing for many years.

FAQs

Q 1: Which is the best large-cap mutual fund for retirement in 2026?

There is no single “best” large-cap fund for everyone, because it depends on your risk tolerance and investment horizon. However, for retirement planning in 2026, investors should prefer large-cap funds that have a consistent long-term track record, a reasonable expense ratio (direct plan), and a diversified portfolio of top Indian companies. Always check the latest factsheet and 3–5 year rolling returns before making an investment. Value Research Online+1

Q Q 2: Are large-cap funds safe for retirement?

Large-cap funds are considered safer than mid-cap and small-cap funds because they invest in well-established companies. However, they are still market-linked and can fall during market crashes. For retirement, large-cap funds work best when you invest for the long term (10+ years), use SIPs, and maintain proper asset allocation with some portion in debt instruments for stability.

Q 3: Should I invest in large-cap funds via SIP or lump sum in 2026?

For most retirement investors, SIP is better because it reduces timing risk and builds investing discipline. A lump sum can be considered only when you have surplus cash and can tolerate short-term volatility. A smart approach is to start a SIP and add a lump sum investment in phases, especially during market dips.

Q 4: How many large-cap funds should I hold for retirement?

For retirement investing, holding 1 to 2 large-cap funds is usually enough. Holding too many funds often creates portfolio overlap and makes tracking difficult. A simple portfolio with fewer high-quality funds works better for long-term retirement compounding.