The Return on Capital Employed (ROCE) calculator is a powerful financial tool that enables businesses and investors to assess the efficiency and profitability of capital investments. This write-up will delve into the ROCE calculator’s mathematical formula, address frequently asked questions (FAQs), and provide an illustrative example to demonstrate its practical application.

Mathematical Formula

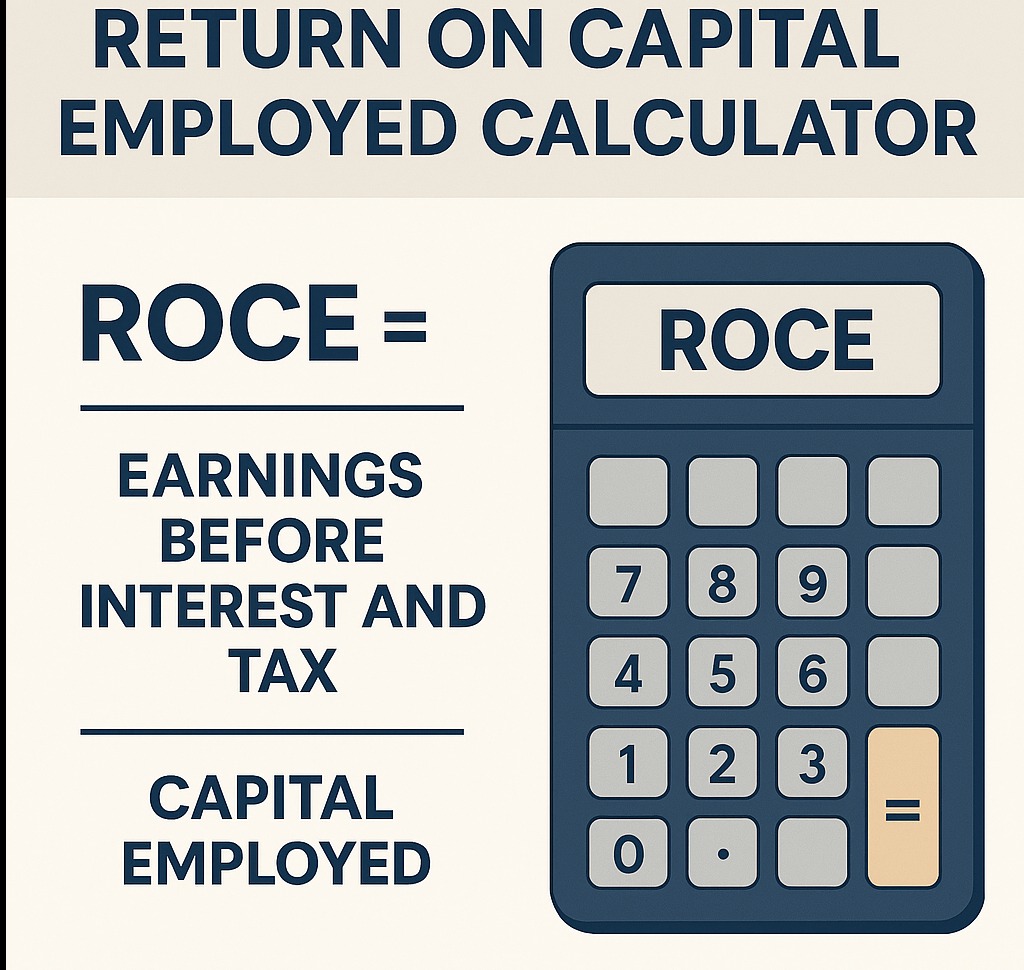

The ROCE is calculated using the following formula:

ROCE (%) = (Net Operating Profit Before Tax / Capital Employed) × 100

Where:

ROCE (%) : The return on capital employed expressed as a percentage.

Net Operating Profit Before Tax : The operating profit generated by a business before accounting for taxes.

Capital Employed : The total amount of capital invested in a business, comprising equity and debt. It can be calculated as total assets minus current liabilities.

Return on Capital Employed Calculator

Return on Capital Employed:

0%

EBIT ($) Capital Employed ($) Calculate

Return on Capital Employed:

0%

FAQs

1. Why is ROCE important for businesses and investors?

ROCE is a critical financial metric that measures how efficiently a business uses its capital to generate profits. It provides valuable insights into a company’s financial health and its ability to create shareholder value.

2. What does a high ROCE indicate?

A high ROCE generally suggests that a company is using its capital efficiently to generate profits. It indicates strong financial performance and can be attractive to investors.

3. Can ROCE be used to compare companies from different industries?

While ROCE is a valuable tool for assessing a company’s financial efficiency, it may not be directly comparable across industries due to variations in capital requirements. It’s more useful when comparing companies within the same industry.

4. How can a business improve its ROCE?

Businesses can improve their ROCE by increasing profitability through cost reduction, revenue growth, or more efficient use of assets. Reducing debt and optimizing capital structure can also enhance ROCE.

5. Are there any drawbacks to relying solely on ROCE for investment decisions?

ROCE provides a valuable snapshot of financial efficiency, but it should be used in conjunction with other financial metrics and qualitative factors. Overemphasis on ROCE alone may lead to incomplete investment decisions.

Example:

Let’s illustrate the ROCE calculator’s functionality with an example:

Suppose Company XYZ generated a Net Operating Profit Before Tax of $500,000 during the fiscal year. The company’s Total Assets amount to $2,000,000, and its Current Liabilities stand at $300,000. Using the ROCE formula, we can calculate the ROCE for Company XYZ:

ROCE (%) = ($500,000 / ($2,000,000 – $300,000)) × 100

ROCE (%) = ($500,000 / $1,700,000) × 100

ROCE (%) ≈ 29.41%

In this scenario:

The ROCE for Company XYZ is approximately 29.41%.

This indicates that for every dollar of capital employed, the company generates a return of 29.41 cents in operating profit before taxes.

Most business owners, investors and analysts use this tool (ROCE ) to understand profit generation thru the investment of total capital ( both equity and long term debt). A higher ROCE means the business is generating good returns by using its funds efficiently.

EBIT (earning before interest and tax indicates how much the business earned from operations.

Capital employed means the total funds (equity, debt and retained earnings)

Ex: A company has EBIT 5 lacs

Total capital employed 20 lacs

Then ROCE=EBIT/total capital employed*100= 5/20*100=25%

Service based industries generally show higher roce while heavy manufacturing may show lower roce. A good thumb rule is that ROCE should be higher than the company’s cost of capital. ROCE is used during analysing business performance, comparing two or more companies and before making investment decisions. It should be used along with other ratios for better analysis.

Conclusion:

The Return on Capital Employed (ROCE) calculator is an invaluable tool for businesses and investors seeking to evaluate financial efficiency and profitability. By understanding its mathematical formula, addressing frequently asked questions, and applying it through an illustrative example, users can make more informed decisions. ROCE empowers businesses to optimize their capital allocation and investors to identify financially healthy and efficient companies. It serves as a vital metric in the financial toolkit, enabling users to measure and manage financial performance effectively.