An unsecured personal loan is not determined by the borrower’s credit history or score with CIBIL (Credit Information Bureau (India) Limited). These loans are also referred to as “poor credit” or “no credit check” loans.

You can get a personal loan without a CIBIL, but it can be harder and have tougher lending requirements because the lender is taking on greater risk by not assessing the borrower’s creditworthiness.

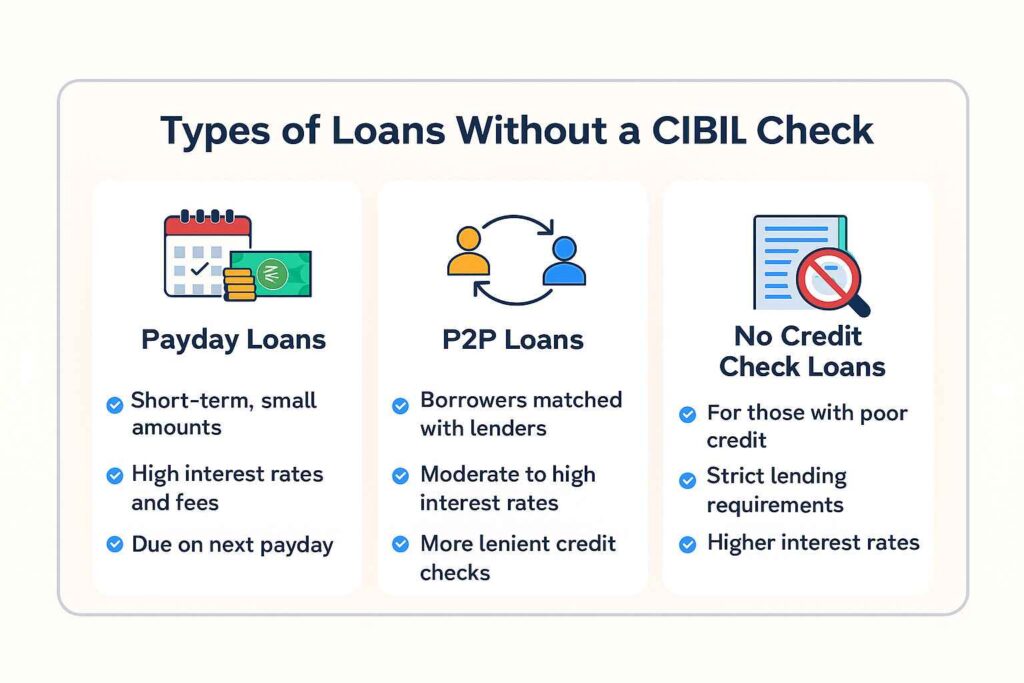

Some personal loans are available without a CIBIL check.

Payday loan: A short-term loan designed to meet urgent cash requirements. This is normally meant to be repaid on your next payday. It is easy to get and does not require a CIBIL check.

Peer-to-peer loan: It is commonly known as a P2P loan. Online platforms connect individual lenders with borrowers. These platforms are more flexible than banks, but charge higher interest rates with higher risk. There is no credit check either.

So you should opt carefully for a personal loan without a CIBIL check.

When applying for personal loans without a CIBIL check, it is vital to exercise caution because they may have higher interest rates and costs and may not be the best choice for everyone. Before choosing a loan option, it’s a good idea to check the terms and circumstances of several loan options, including interest rates, fees, and payback terms, and to speak with a financial advisor.

Personal loan with no income evidence

An unsecured personal loan is not based on the borrower’s work or income. These loans are also referred to as “no income evidence” or “no income verification” loans.

While it is possible to get a personal loan without a salary transfer, the process could be more challenging and subject to tougher lending requirements because the lender is taking on more risk by doing so.

Here are some instances of personal loans without an income transfer requirement:

- Loans without income verification: Self-employed people and those who have trouble proving their income may be eligible for these loans. They can have stricter lending requirements and higher interest rates.

- Signature loans: These unsecured loans depend more on the borrower’s reputation and trustworthiness than they do on their income. They could have higher interest rates than loans with collateral.

- P2P loans: Platforms for peer-to-peer lending pair borrowers with lenders who provide the money for their loans. While these platforms might not demand as severe an income verification as traditional banks, interest rates might be quite hefty.

When applying for personal loans without salary transfer, it is crucial to exercise caution because they may have higher interest rates and costs and may not be the best choice for everyone. Before choosing a loan option, it’s a good idea to check the terms and circumstances of several loan options, including interest rates, fees, and payback terms, and to speak with a financial advisor.

Additionally, it’s critical to keep in mind that lenders generally consider a borrower’s creditworthiness, so even with evidence of income, it will be more difficult to have a loan accepted if you don’t have a solid credit history or score.

Although a lender does not ask for formal income documents , but they prefer applicants income documents as to know their level of financial responsibility. Without a good credit profile even income proof free loans are difficult to qualify for. Good financial track record makes long term borrowing flexible.